Investing.com-- Asian stocks rose on Friday amid cooling fears that a U.S. recession was imminent, while mildly positive inflation data from China also helped spruce up sentiment.

But regional markets were still headed for weekly losses after marking steep declines at the beginning of the week.

Asian stocks took a positive lead-in from Wall Street, as better-than-expected jobless claims data fueled hopes that the U.S. labor market was not in as dire straits as initially feared.

U.S. stock index futures rose slightly in Asian trade.

Chinese markets lag, but CPI data reads positive

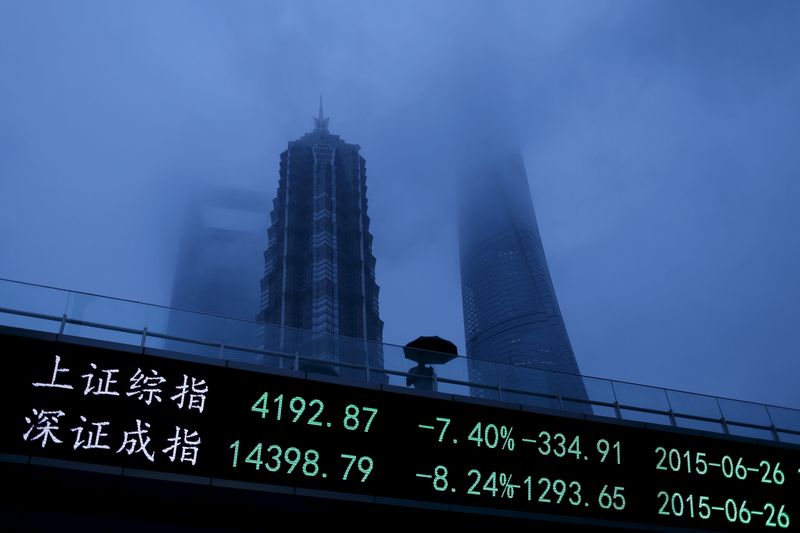

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes rose 0.3% each, relatively less than most of their Asian peers. Both indexes were down about 0.8% this week, a third straight week of losses.

But inflation data from the country showed some improving trends. Consumer price index inflation picked up more than expected, while producer price index inflation shrank at a slower than expected pace.

The reading indicated that a series of interest rate cuts by the People’s Bank through July were bearing some fruit, although it remained to be seen whether China’s deflationary trend would be sustainably reversed.

Sentiment towards Chinese markets soured substantially in recent weeks, following a string of weak economic readings from the country. The country’s benchmark indexes remained close to six-month lows.

Japanese stocks surge, sharply pare weekly losses

Japan’s Nikkei 225 and TOPIX indexes surged 2% and 1.5%, respectively, on Friday.

The two were still set to lose about 1.5% this week, but had also recouped a bulk of losses made earlier in the week.

A rebound in Japanese markets came as Bank of Japan officials attempted to downplay the central bank’s unexpectedly hawkish messaging from last week.

Bargain hunting in heavyweight tech stocks also aided Japanese indexes, as did positive earnings from majors including Tokyo Electron. The stock rose 1.7% after clocking stronger-than-expected earnings in the June quarter, as it flagged increased demand from the artificial intelligence sector.

Broader Asian stocks advanced, with tech-heavy bourses such as South Korea’s KOSPI and Hong Kong’s Hang Seng index up between 1.5% and 2%. Gains in tech came in tandem with a rebound in U.S. markets.

Australia’s ASX 200 rose 1.4% and was down 1.9% this week, also recouping a bulk of its losses this week.

Futures for India’s Nifty 50 index pointed to a slightly positive open, after the index and the BSE Sensex 30 fell on Thursday after the Reserve Bank of India struck an unexpectedly hawkish tone, while also slightly downgrading its outlook for growth in the current quarter.