* Brent oil tops $50/barrel first time in nearly 7 months

* European, Asian shares edge up; commodity stocks

outperform

* Dollar falls vs yen, euro

* Oil lifts ECB's favoured inflation expectations gauge

By Nigel Stephenson

LONDON, May 26 (Reuters) - Brent crude oil topped $50 a

barrel for the first time in nearly seven months on Thursday,

lifting commodity and energy-related shares in Europe and Asia,

though worries about U.S. interest rates and signs of slowdown

in China limited gains.

Oil's rise took it to levels more than 80 percent above

January's 12-year lows and was fuelled in part by a weaker

dollar, which fell against the Japanese yen.

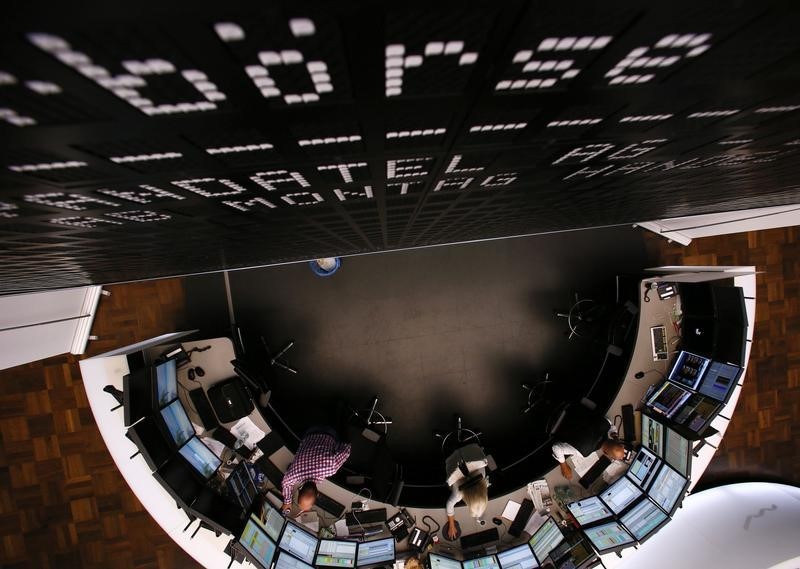

European shares edged higher, led by the basic resources and

oil and gas sectors. The pan-European FTSEurofirst 300 index

.FTEU3 rose 0.1 percent, pushing on from a four-week high hit

on Wednesday. The STOXX 600 basic resources index .SXPP rose

2.6 percent. Oil and gas .SXEP added 0.4 percent.

Wall Street looked set to open with modest gains, according

to index futures ESc1 SPc1 1YMc1 .

Within Europe, gains of 0.5 percent in Germany's DAX index

.GDAXI and 0.4 percent in France's CAC 40 .FCHI were offset

by losses of 0.6 percent in Spain's IBEX .IBEX and 0.3 percent

in Italy's FTSE MIB index .FTMIB .

Japan's Nikkei .N225 rose 0.1 percent, giving up earlier

gains as the yen firmed, while MSCI's broadest index of

Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.4

percent.

Chinese shares fell more than 1 percent at one point, with

the CSI300 index .CSI300 touching its lowest since March 11

after data on Thursday showed profits at state-owned firms fell

8.4 percent year-on-year in the first four months of 2016, while

debts rose 18 percent. However, a late rally saw the index close

0.2 percent higher.

Brent LCOc1 , the international benchmark oil price, rose

as high as $50.35 a barrel, its highest since early November, in

the wake of data showing a sharper-than-expected fall in U.S.

crude stocks last week.

U.S. crude CLc1 last traded at $49.90, up 34 cents.

"Geopolitical issues in West Africa and the Middle East,

supply outages, increased demand and maybe a touch of a weaker

dollar have all helped push prices higher," said Jonathan

Barratt, chief investment officer at Sydney's Ayers Alliance.

He added, however, that the rally would not last as the

higher prices would bring U.S. shale oil back on to the market.

In currency markets, the yen JPY= rose 0.2 percent to 110

per dollar and the euro EUR= was up 0.3 percent at $1.1182.

"Stuck in a corridor is a good word for the yen at the

moment," said Geoffrey Yu, a strategist with the UBS in London.

"For Japan the question is what will we see next from them

to ensure that the yen can stay weak."

The greenback hit a two-month high .DXY against a basket

of currencies on Wednesday, and is on a roll after minutes of

the Federal Reserve's latest policy meeting and comments from

Fed officials hinted that an interest rate rise could be

imminent.

The cost of hedging against big swings in sterling GBP=

over the next month hit seven-year highs on Thursday GBP1MO= ,

according to options set to mature just after Britain's June 23

refereendum on European Union membership. TO YELLEN

Investors are looking to a speech by Fed Chair Janet Yellen

on Friday for more clues to the rate outlook.

Yields on two-year U.S. Treasuries US2YT=RR hit 10-week

highs around 0.94 percent on Wednesday. They last stood at 0.91

percent down 1 basis point on the day.

German 10-year yields DE10YT=TWEB , the benchmark for euro

zone borrowing costs, rose about 2 bps to 0.17 percent.

The market is already turning to next Thursday's European

Central Bank policy meeting, at which it will unveil new growth

and inflation forecasts.

Higher oil prices have helped lift a gauge of long-term

inflation expectations often cited by the ECB - the five-year,

five-year breakeven rate EUIL5Y5Y=R> - above 1.5 percent, though

this remains below the ECB's inflation target of near 2 percent.