(Bloomberg) -- Asian stocks, U.S. and European equity futures pushed higher Friday as the latest reading on China’s economy beat expectations, offering some reassurance to investors concerned about the global growth outlook. Treasury yields held gains.

Weakness in the yen helped boost Japanese shares, while Chinese equities outperformed. South Korea was shut. An increase in the Caixin manufacturing gauge to a three-month high and confirmation that MSCI Inc. will increase the weight of Chinese stocks in its global benchmarks buoyed sentiment. S&P 500 Index futures pointed to gains after the benchmark closed lower Thursday, while the dollar ticked higher.

“The news surrounding China and the Chinese economy has been better than news we’ve seen elsewhere,” Andrew Cole, head of multi asset at Pictet Asset Management Ltd., told Bloomberg TV in Hong Kong. “Clearly the central bank and the authorities are providing both fiscal and monetary stimulus.”

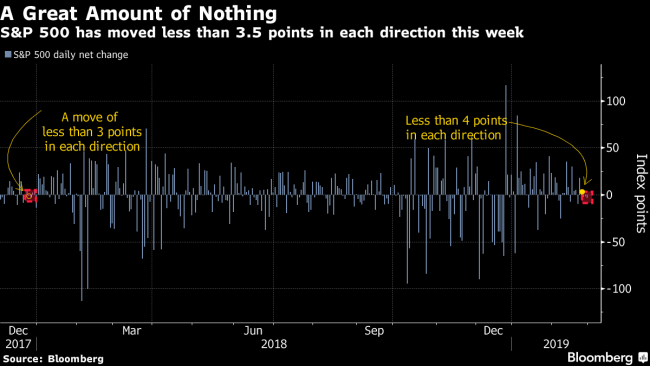

After a 16 percent surge from Christmas through the start of this week, MSCI’s gauge of global equities has been treading water as investors await results from U.S.-China trade negotiations. American officials are preparing a final trade deal that Donald Trump and China President Xi Jinping could sign in weeks, people familiar with the matter said, even as a debate continues in Washington over whether to push Beijing for more concessions.

Geopolitical concerns remain in the background, amid tensions between India and Pakistan and the failure of a summit between Kim Jong Un and Trump to achieve a deal between the U.S. and North Korea.

Elsewhere, oil climbed back above $57 a barrel in New York as evidence of OPEC cuts and strengthening economic trends in the U.S. signaled tightening supplies.

These are the main moves in markets:

Stocks

- The MSCI Asia Pacific rose 0.2 percent as of 3:22 p.m. in Hong Kong.

- Japan’s Topix index closed up 0.5 percent.

- Hong Kong’s Hang Seng added 0.5 percent. The Hang Seng China Enterprises Index advanced 0.8 percent.

- The Shanghai Composite climbed 1.8 percent.

- Futures on the S&P 500 Index rose 0.5 percent after the underlying gauge fell 0.3 percent Thursday.

- {{8867|Euro Stoxx 50 futures}} gained 0.5 percent.

Currencies

- The yen fell 0.4 percent to 111.81 per dollar.

- The offshore yuan fell less than 0.1 percent to 6.7062 per dollar.

- The euro was flat at $1.1373.

- The British pound bought $1.3255.

Bonds

- The yield on 10-year Treasuries held at about 2.72 percent.

- Australia’s 10-year yield climbed about five basis points to 2.15 percent.

Commodities

- West Texas Intermediate rose 0.7 percent to $57.68 a barrel.

- Gold was steady at $1,312.23 an ounce.